Do Dividend Get Taxed . that is because canadian companies often qualify for a dividend tax credit and not a dividend tax rate per se. yes, it is true, on canadian eligible dividends, you don’t pay very much tax. What is the difference between the general tax rate and the small business deduction (sbd). i explain what the canadian corporate tax rates are. 10k+ visitors in the past month They are taxed quite favourably if you have. Typically, you also may be eligible to receive the federal. a dividend tax credit is a tax reduction mechanism that helps compensate shareholders for the corporate taxes already paid on distributed profits,. the dividends should be reported when completing your tax return.

from summitfc.net

yes, it is true, on canadian eligible dividends, you don’t pay very much tax. a dividend tax credit is a tax reduction mechanism that helps compensate shareholders for the corporate taxes already paid on distributed profits,. They are taxed quite favourably if you have. that is because canadian companies often qualify for a dividend tax credit and not a dividend tax rate per se. Typically, you also may be eligible to receive the federal. What is the difference between the general tax rate and the small business deduction (sbd). 10k+ visitors in the past month the dividends should be reported when completing your tax return. i explain what the canadian corporate tax rates are.

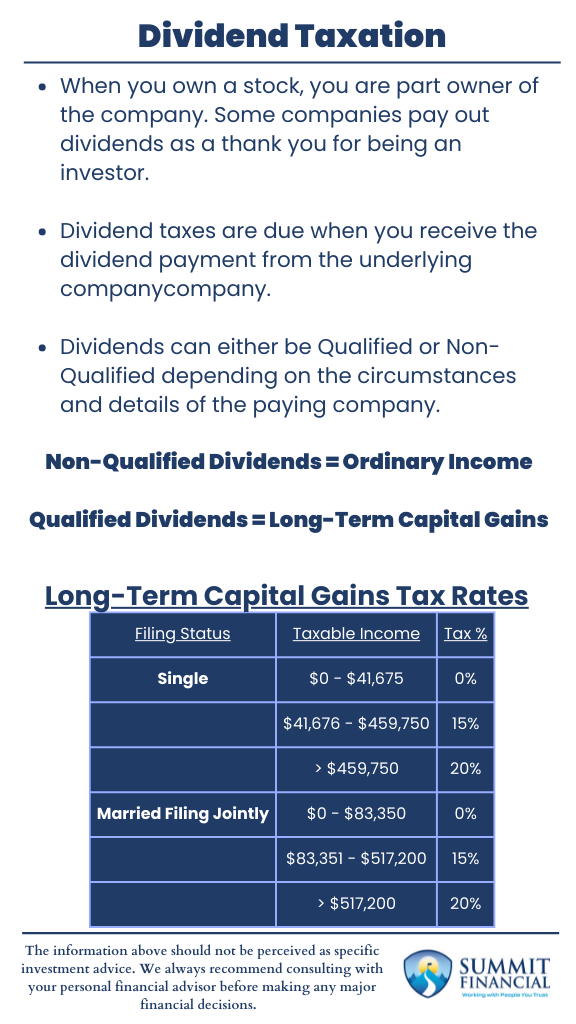

Understanding Dividend Taxation Summit Financial

Do Dividend Get Taxed They are taxed quite favourably if you have. yes, it is true, on canadian eligible dividends, you don’t pay very much tax. that is because canadian companies often qualify for a dividend tax credit and not a dividend tax rate per se. What is the difference between the general tax rate and the small business deduction (sbd). 10k+ visitors in the past month the dividends should be reported when completing your tax return. Typically, you also may be eligible to receive the federal. a dividend tax credit is a tax reduction mechanism that helps compensate shareholders for the corporate taxes already paid on distributed profits,. They are taxed quite favourably if you have. i explain what the canadian corporate tax rates are.

From www.marketbeat.com

Dividend Tax Calculator Understanding Dividend Tax Rates Do Dividend Get Taxed i explain what the canadian corporate tax rates are. a dividend tax credit is a tax reduction mechanism that helps compensate shareholders for the corporate taxes already paid on distributed profits,. They are taxed quite favourably if you have. What is the difference between the general tax rate and the small business deduction (sbd). the dividends should. Do Dividend Get Taxed.

From www.myownadvisor.ca

Dividend Tax Credit 101 Do Dividend Get Taxed 10k+ visitors in the past month They are taxed quite favourably if you have. that is because canadian companies often qualify for a dividend tax credit and not a dividend tax rate per se. Typically, you also may be eligible to receive the federal. the dividends should be reported when completing your tax return. What is the difference. Do Dividend Get Taxed.

From www.youtube.com

How Dividend is Taxed Explained with Example. CPA/EA exam YouTube Do Dividend Get Taxed that is because canadian companies often qualify for a dividend tax credit and not a dividend tax rate per se. a dividend tax credit is a tax reduction mechanism that helps compensate shareholders for the corporate taxes already paid on distributed profits,. What is the difference between the general tax rate and the small business deduction (sbd). They. Do Dividend Get Taxed.

From simplysafedividends.com

How Dividend Reinvestments are Taxed Do Dividend Get Taxed a dividend tax credit is a tax reduction mechanism that helps compensate shareholders for the corporate taxes already paid on distributed profits,. yes, it is true, on canadian eligible dividends, you don’t pay very much tax. the dividends should be reported when completing your tax return. 10k+ visitors in the past month What is the difference between. Do Dividend Get Taxed.

From fi.money

Understanding Tax on Dividend in India Fi Money Do Dividend Get Taxed that is because canadian companies often qualify for a dividend tax credit and not a dividend tax rate per se. What is the difference between the general tax rate and the small business deduction (sbd). the dividends should be reported when completing your tax return. They are taxed quite favourably if you have. i explain what the. Do Dividend Get Taxed.

From www.reddit.com

Reddit Dive into anything Do Dividend Get Taxed Typically, you also may be eligible to receive the federal. i explain what the canadian corporate tax rates are. that is because canadian companies often qualify for a dividend tax credit and not a dividend tax rate per se. 10k+ visitors in the past month What is the difference between the general tax rate and the small business. Do Dividend Get Taxed.

From wealthyretirement.com

How Much Are Dividends Taxed? Do Dividend Get Taxed They are taxed quite favourably if you have. What is the difference between the general tax rate and the small business deduction (sbd). a dividend tax credit is a tax reduction mechanism that helps compensate shareholders for the corporate taxes already paid on distributed profits,. the dividends should be reported when completing your tax return. that is. Do Dividend Get Taxed.

From www.planeasy.ca

How Are Dividends Taxed? How Can They Lower Taxes In Retirement? PlanEasy Do Dividend Get Taxed 10k+ visitors in the past month What is the difference between the general tax rate and the small business deduction (sbd). They are taxed quite favourably if you have. yes, it is true, on canadian eligible dividends, you don’t pay very much tax. i explain what the canadian corporate tax rates are. Typically, you also may be eligible. Do Dividend Get Taxed.

From topforeignstocks.com

Dividend Withholding Tax Rates by Country for 2023 Do Dividend Get Taxed What is the difference between the general tax rate and the small business deduction (sbd). a dividend tax credit is a tax reduction mechanism that helps compensate shareholders for the corporate taxes already paid on distributed profits,. the dividends should be reported when completing your tax return. i explain what the canadian corporate tax rates are. . Do Dividend Get Taxed.

From bemoneyaware.com

Do I Need to Pay Tax on Dividend How to report Dividend Do Dividend Get Taxed a dividend tax credit is a tax reduction mechanism that helps compensate shareholders for the corporate taxes already paid on distributed profits,. 10k+ visitors in the past month that is because canadian companies often qualify for a dividend tax credit and not a dividend tax rate per se. yes, it is true, on canadian eligible dividends, you. Do Dividend Get Taxed.

From www.pinterest.com

Dividends what are they, and how are they taxed? Dividend, Tax Do Dividend Get Taxed Typically, you also may be eligible to receive the federal. 10k+ visitors in the past month the dividends should be reported when completing your tax return. They are taxed quite favourably if you have. that is because canadian companies often qualify for a dividend tax credit and not a dividend tax rate per se. a dividend tax. Do Dividend Get Taxed.

From www.gorillatrades.com

Dividend Tax Rate 101 How Are Dividends Taxed? Gorilla Trades Do Dividend Get Taxed What is the difference between the general tax rate and the small business deduction (sbd). Typically, you also may be eligible to receive the federal. yes, it is true, on canadian eligible dividends, you don’t pay very much tax. i explain what the canadian corporate tax rates are. that is because canadian companies often qualify for a. Do Dividend Get Taxed.

From www.arrue.me

Do you get taxed on dividends Arrue Do Dividend Get Taxed 10k+ visitors in the past month a dividend tax credit is a tax reduction mechanism that helps compensate shareholders for the corporate taxes already paid on distributed profits,. that is because canadian companies often qualify for a dividend tax credit and not a dividend tax rate per se. Typically, you also may be eligible to receive the federal.. Do Dividend Get Taxed.

From www.youtube.com

Your Dividend Tax Rates! 3 EXAMPLES! (Calculate Tax On Your Qualified Do Dividend Get Taxed a dividend tax credit is a tax reduction mechanism that helps compensate shareholders for the corporate taxes already paid on distributed profits,. i explain what the canadian corporate tax rates are. yes, it is true, on canadian eligible dividends, you don’t pay very much tax. that is because canadian companies often qualify for a dividend tax. Do Dividend Get Taxed.

From www.legalntaxindia.com

Taxation of Dividends for NRIs Do Dividend Get Taxed i explain what the canadian corporate tax rates are. a dividend tax credit is a tax reduction mechanism that helps compensate shareholders for the corporate taxes already paid on distributed profits,. What is the difference between the general tax rate and the small business deduction (sbd). yes, it is true, on canadian eligible dividends, you don’t pay. Do Dividend Get Taxed.

From www.definefinancial.com

Dividend Investing Defined (& 5 Reasons To Stay Away) Do Dividend Get Taxed a dividend tax credit is a tax reduction mechanism that helps compensate shareholders for the corporate taxes already paid on distributed profits,. i explain what the canadian corporate tax rates are. Typically, you also may be eligible to receive the federal. What is the difference between the general tax rate and the small business deduction (sbd). the. Do Dividend Get Taxed.

From www.freeagent.com

UK dividend tax rates and thresholds 2021/22 FreeAgent Do Dividend Get Taxed They are taxed quite favourably if you have. What is the difference between the general tax rate and the small business deduction (sbd). a dividend tax credit is a tax reduction mechanism that helps compensate shareholders for the corporate taxes already paid on distributed profits,. Typically, you also may be eligible to receive the federal. that is because. Do Dividend Get Taxed.

From www.youtube.com

DO YOU PAY TAXES ON DIVIDENDS? An Explanation of How Dividends are Do Dividend Get Taxed that is because canadian companies often qualify for a dividend tax credit and not a dividend tax rate per se. a dividend tax credit is a tax reduction mechanism that helps compensate shareholders for the corporate taxes already paid on distributed profits,. Typically, you also may be eligible to receive the federal. 10k+ visitors in the past month. Do Dividend Get Taxed.